Slidell Bankruptcy Lawyers

Helping debtors in Slidell obtain financial relief

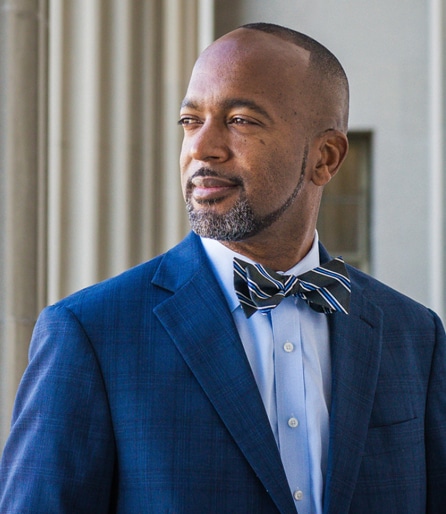

Filing for bankruptcy is not something to be ashamed of. Numerous individuals turn to bankruptcy due to job loss, unaffordable medical expenses, post-divorce living adjustments, or various other circumstances. At the Law Office of James A. Graham, our Slidell bankruptcy lawyers carefully assess your debt situation and elucidate the available options. We collaborate with your creditors and the bankruptcy trustee to facilitate payment arrangements for manageable debts while discharging the remainder. Many Slidell residents are burdened with credit card debt, and some experience financial setbacks as property values decline. Regardless of the cause, it's essential to understand that bankruptcy offers relief from creditor harassment, allowing you to regain control of your financial life.

How can we help?

- What are the different kinds of debts?

- Are there alternatives to bankruptcy in Slidell?

- What is the “automatic stay” provision?

- What is a Chapter 7 bankruptcy?

- How does the means test work in Slidell?

- What is a Chapter 13 bankruptcy?

- How might filing for bankruptcy affect my credit rating?

- Do you have a Slidell bankruptcy lawyer near me?

What are the different kinds of debts?

To thoroughly understand your overall financial situation, we will conduct a comprehensive examination of all your debts, income, and assets. Debts fall into various categories:

- Secured debts: These are debts for which you provided collateral, such as property, as security. In the event of default, the creditor has the right to seize the pledged property to settle the outstanding balance. A common example of a secured debt is a mortgage, where your home is collateral. Many auto loans also involve granting a security interest in the financed vehicle.

- Unsecured debts: These are debts without collateral, such as credit card balances and medical bills.

- Priority debts: Certain debts are categorized as priority debts, and they cannot be discharged in bankruptcy. Examples include child support, income taxes, and student loan debt.

Are there alternatives to bankruptcy in Slidell?

Even the Founding Fathers foresaw the possibility that individuals might require assistance during financial challenges, and as a result, the U.S. Constitution protects the right to file for bankruptcy. However, many would rather avoid filing for bankruptcy by negotiating with creditors to extend loan payments or reduce their amounts. Another option to avoid bankruptcy is securing a new loan to settle existing debts. Although the new loan will require repayment, it might offer a lower interest rate than the existing ones.

What is the “automatic stay” provision?

The automatic stay provision provides prompt relief from incessant creditor communication, delinquency notices, and legal actions, such as foreclosure proceedings. Upon filing a Chapter 7 or Chapter 13 bankruptcy petition, all collection activities by creditors must immediately cease. The Bankruptcy Court appoints a trustee to represent their interests. This stay alleviates the pressure of creditor harassment while you address your financial matters. Although there are circumstances where creditors may seek relief from the automatic stay, in most instances, it remains in force until your bankruptcy discharge.

What is a Chapter 7 bankruptcy?

Chapter 7 bankruptcy, also known as liquidation, can be a viable option when there are no secured debts involved. For example, individuals saddled with credit card debt and medical bills often opt for Chapter 7 bankruptcy if they don’t own a home, lack other secured debts, and do not have significant assets. In Chapter 7 bankruptcy, certain assets, such as home equity, vehicles, bank accounts, jewelry, and tools of your trade, can be safeguarded up to specific dollar limits. Reaffirmation agreements can also be established to protect certain assets, such as automobiles, allowing the debtor to continue making payments after the bankruptcy discharge.

Our Slidell bankruptcy attorneys will initiate the filing process on your behalf, attend the trustee meeting with you, and address any concerns creditors raise. Following the trustee meeting, if complications are minimal (which is usually the case), the Judge will issue an order discharging all unsecured debts.

How does the means test work in Slidell?

Revisions to federal bankruptcy regulations in 2005 introduced a means test requiring debtors to assess their eligibility for Chapter 7 bankruptcy. This test evaluates your income and compares it to regional averages based on the same family size. If your income exceeds the limit, you will be required to file for Chapter 13 bankruptcy. Our Slidell bankruptcy attorneys will clarify which income is considered and which isn't. For example, Social Security income is generally excluded from the means test calculations.

What is a Chapter 13 bankruptcy?

Chapter 13 bankruptcy, sometimes called a wage earner's plan, gives individuals with regular income the opportunity to formulate a plan to repay either all or a portion of their debts.

Within this bankruptcy framework, debtors outline a repayment strategy to make periodic payments to creditors over a designated period, typically spanning three to five years.

Chapter 13 bankruptcy is often chosen by debtors seeking to preserve their homes or other secured assets.

Chapter 13 bankruptcy obliges debtors to submit a plan post-petition filing, and ongoing payments for secured debts must be maintained. Priority debts are non-dischargeable, but arrears can usually be addressed over the three-to-five-year period, contingent on meeting upcoming payment obligations (such as family support and taxes). Upon successful completion of the planned payments, the remaining unsecured debts are discharged, while secured property is retained. Continued payments on secured property are still required after the plan is complete.

How might filing for bankruptcy affect my credit rating?

Filing for bankruptcy can have a significant impact on your credit rating. The exact effect and duration can vary based on the type of bankruptcy you file (Chapter 7 or Chapter 13) and your individual financial situation. Here are some points to consider:

- Chapter 7 bankruptcy: A Chapter 7 bankruptcy remains on your credit report for up to 10 years from the filing date. During this time, it can have a substantial negative impact on your credit score. However, the impact tends to diminish over time, especially if you take steps to rebuild your credit.

- Chapter 13 bankruptcy: A Chapter 13 bankruptcy typically remains on your credit report for seven years from the filing date. Since Chapter 13 involves a repayment plan and partial debt discharge, its impact may be perceived as less severe than Chapter 7.

- Credit score impact: Initially, your credit score will likely drop significantly after a bankruptcy filing. The severity of the impact depends on your credit score before filing, with higher scores experiencing a more substantial decline. However, as time passes and you demonstrate responsible financial behavior, the negative impact lessens.

- Rebuilding credit: Despite the initial challenges, it is possible to rebuild your credit after bankruptcy. Responsible financial habits, such as making timely payments on any remaining debts, obtaining a secured credit card, and managing credit responsibly, can contribute to gradual improvement.

- Credit opportunities: While bankruptcy may limit immediate access to credit, some lenders specialize in working with individuals with a bankruptcy history. You might be able to obtain secured credit cards and loans to help you reestablish credit.

Do you have a Slidell bankruptcy lawyer near me?

The Law Office of James A. Graham serves clients throughout South Louisiana. We are located at 1929 2nd St #A, Slidell, LA 70458. We also have a location in New Orleans, and we will schedule phone or video conferences as needed for those who are unable to travel to our offices.

Get help from a respected Slidell bankruptcy lawyer today

Are you tired of being harassed by creditors and are looking for relief? At the Law Office of James A. Graham, we've assisted numerous debtors in obtaining a new beginning. We'll guide you in exploring your bankruptcy alternatives and determining whether a Chapter 7 or Chapter 13 filing is appropriate based on your individual circumstances. We’ll act as your advocate with the assigned trustee and provide insights into post-bankruptcy measures to gradually rebuild your credit. For a comprehensive discussion on all aspects of bankruptcy, please contact us or fill out our contact form to arrange a consultation with a reputable bankruptcy attorney in Slidell today.